The start-up stages of a business can often involve a

sizeable amount of trial-and-error, which involves trying out different product

offerings, marketing methods, and sales approaches. At the start-up stage, this

is often undertaken without the benefit of a refined and mature set of business

processes. Many business experts argue that the trial-and-error approach is a

bad one; however, the early part of a business’s life - or the beginning of an

entrepreneurial career - can benefit from the use of trial-and-error as it can

offer many opportunities for learning.

Once a business matures out of this stage, strategy and

process refinement and development are important elements of scaling the

business to a larger size. Particularly, driving growth needs an approach that

moves key processes like sales and marketing away from requiring the input of the

owner(s), and towards a system that is much more automated.

Knowing Your Numbers

A solid grasp of your financials is an important part of

being in business. Without the knowledge of which products make you the most

profit, or whether you are making any profit at all, you can’t understand which

area of your business would benefit most from your effort and attention.

An income statement (also known as a profit and loss account)

is a business document that allows the owner to see the performance of their

business over a defined period of time in the past. This is often used to

understand the health of the business over the past financial year, or one

particularly quarter. In addition to other financial tools, including the

balance sheet, the income statement can be great for allowing you to see how

well your business has performed. Yet, while they are great for understanding

the past, they are not particularly helpful when forecasting the future.

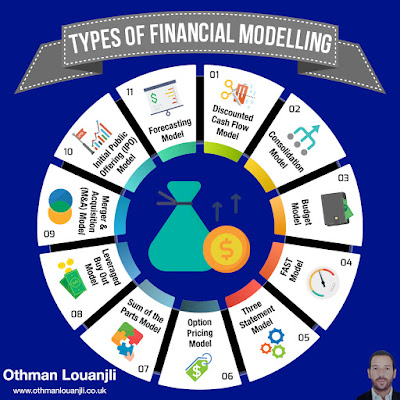

Financial Modelling

Financial modelling takes a number of different inputs, such as

historical financial data from the income statements and balance sheets, to

predict how the business will perform in the future. By undertaking financial

modelling like this, business owners are able to make better decisions, as well

as better understand the impact of such decisions and forecast trends.

Financial models are commonly used in the financial

industry, with bankers and investors such as Othman

Louanjli of Julius Baer creating financial models as part of their

jobs. In addition to this application, financial models can also be used to

help business owners understand the drivers of their businesses, finding

opportunities to drive growth.

|

Understanding the Profit and LossAccount

|

No comments:

Post a Comment

Note: only a member of this blog may post a comment.