Federer’s achievements have earned him millions of fans from around the

world, including Othman Louanjli, who is a United Arab Emirates-based private banker.

What is Wimbledon?

Wimbledon, officially known as The Championships, Wimbledon, is a tennis tournament that is played on the All England Club’s outdoor grass courts in London. The yearly championship started on the 9th July 1877 with the Gentlemen’s Singles being the only game. Wimbledon is one of the major tennis tournaments known as a Grand Slam. The three other majors are the US Open, The French Open and the Australian Open.

Wimbledon, officially known as The Championships, Wimbledon, is a tennis tournament that is played on the All England Club’s outdoor grass courts in London. The yearly championship started on the 9th July 1877 with the Gentlemen’s Singles being the only game. Wimbledon is one of the major tennis tournaments known as a Grand Slam. The three other majors are the US Open, The French Open and the Australian Open.

Due to Wimbledon’s long history, it has developed many traditions, which

include players adhering to a strict dress code and a Royal Patron.

Roger Federer Beats Dusan Lajovic

Roger Federer Beats Dusan Lajovic

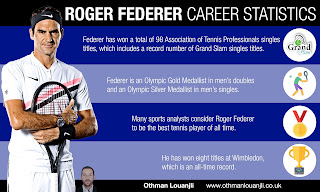

Roger Federer is a Swiss-born tennis player. In 1998, Federer became a

professional player, and he currently holds the number two spot on the men’s

singles tennis list, created by the Association of Tennis Professionals.

Federer is a record-breaking champion, having won the Wimbledon title eight

times in a row. He also won the Australian Open six times, played in 30 Grand

Slam finals and he is the recipient of thirteen Stefan Edberg Sportsmanship

awards.

After a long tennis career, Federer is now classed as one of the world’s

best players.

During his first Wimbledon 2018 game, Federer showed how he was still in

great form by continuing his tradition of sailing through the first round. It

only took the Swiss player 79 minutes to defeat Lajovic, who was the world’s 57th

ranked male tennis player at the time, with Federer winning 6-1 6-3 6-4 against

the Serbian player.